Medicare Market Insights and Plan Competition for 2024

October 19,2023

Medicare Advantage (MA) plans have been preparing their Medicare products in anticipation of the 2024 Annual Election Period (AEP), which is now upon us. The Medicare Advantage market is comprised of national health plans, Blue Cross Blue Shield organizations, prominent regional health plans and specialized Medicare companies. MA plans currently provide medical coverage for nearly 32.6 million beneficiaries, as of September 2023. While MA market penetration is strong, there is still ample opportunity for growth in this segment, with approximately 49% of the 66 million people eligible for Medicare enrolled in MA plans. This brief presents a snapshot of the 2024 Medicare Advantage market with insights from the Centers for Medicare and Medicaid Services (CMS) Medicare Landscape reports and Medicare Benefits Analyzer™.

Medicare Advantage plans have collectively increased enrollment by approximately 7.1 million members in the past three years. The 2024 Annual Election Period (AEP) for Medicare Advantage (MA) plans and prescription drug plans (PDPs) is currently underway as of October 15th. Medicare Benefits Analyzer™, a Mark Farrah Associates’ database, helps simplify analysis of the Medicare.gov data for companies competing in this segment.

Based on an aggregate analysis of CMS Landscape reports, a total of 5,805 distinct Medicare Advantage (MA) plan offerings are in the market lineup for the 2024 AEP. This includes MA plans, Medicare Advantage with prescription drug plans (MAPDs), Medicare/Medicaid plans (MMPs), and Special Needs Plans (SNPs). During the AEP, Medicare beneficiaries can choose to change MA plans or switch from Original Medicare to MA, for plan benefits effective on January 1, 2024. As indicated in the charts below:

- A total of 4,428 MA and MAPD plans are being offered for 2024, which is a slight decrease from the 4,431 plans offered for 2023.

- Health Maintenance Organizations (HMOs) continue to be the dominant MA plan type with 2,445 offerings, or 55% of MA plans for the coming year.

- A total of 3,944, or 89% of MA plans, include Part D benefits.

- 1,377 Special Needs Plans (SNPs) are available for 2024, up from 1,333 in 2023.

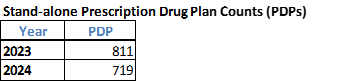

- Stand-alone PDPs, nationwide, notably decreased from 811 plans in 2023 to 719 plan offerings for 2024.

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Landscape Source Files; excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

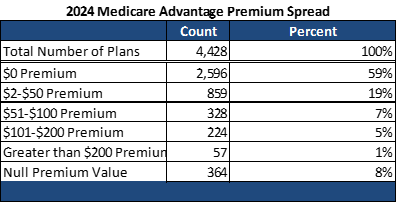

2024 MA Premium Spread

Per the chart below, 59% of 2024 MA plans (excluding SNPs) are available at the $0 plan premium level, and 19% of plans will be charging monthly premiums ranging from $2 to $50. Only 57 plans (1%) are charging monthly premiums greater than $200. These benefits-rich plans typically have low copays and as a result, estimated out-of-pocket expenses are often minimal.

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare Plan Finder and Landscape Source Files; excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

2024 MA Plan Competition

- According to the 2024 CMS Medicare Landscape Source Files, CVS continues to broaden its offerings and expand coverage, with 642 distinct plans. CVS and Centene, with 294 plans, had the best performance among the larger plans.

- Humana also continued to increase MA plan offerings and expand $0 premium plan options for the 2024 calendar year, identifying 605 distinct plans.

- UnitedHealth offers the second largest number of MA plans, at 620, a 22% year-over-year increase.

- BCBS companies and affiliates (excluding Elevance) are offering 551 MA plans, nationwide.

- Centene is offering 294 MA plans and Cigna has 258 plans for 2024.

- Elevance Health, previously Anthem Inc., decreased its plan selection by 33%, now offering 208 plans for 2024.

- The insurance start-up, Devoted Health, increased its MA plan offerings to 118 as it continues to expand, and Kaiser Permanente has 77 plans in the market line-up for 2024.

Source: Mark Farrah Associates' Medicare Benefits Analyzer TM presenting data from CMS Medicare.gov and Landscape Source Files; excludes employer-sponsored plans. For this assessment, plans were counted as distinct company records by Contract-Plan-Segment ID without geographic distribution.

Medicare Benefits AnalyzerTM for Comparing Medicare Benefits

Analysts often use benefits data from the Medicare.gov website to compare plan premiums, copays, and star quality rating awards, market-by-market. Identifying plan-by-plan benefits details such as annual Out-of-Pocket Limits and Deductibles; Primary Care Doctor Visit Copays; Specialist Doctor Visit Copays; Inpatient Hospital Copays; Ambulance and Emergency Room Copays; and Drug Tier Copays helps companies to assess competitive advantages across markets. This type of comparative analysis provides invaluable intelligence that prepares Medicare plans to promote and sell their products.

In order to help Medicare plans access and use Medicare.gov data more efficiently, Mark Farrah Associates (MFA) maintains this data in its Medicare Benefits AnalyzerTM product. Benefits detail for 2024 is online now, along with Star Quality Ratings. Subscribers may query tables presenting plan benefit comparisons by state and county or download large datasets using the file export interface. Subscribers also have access to Medicare Business Online™ for tracking month-to-month Medicare Advantage and Prescription Drug Plan enrollment changes. Visit our website at www.markfarrah.com or call 724-338-4100 for more information.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, Medicare Business Online™, Medicare Benefits Analyzer™, 5500 Employer Health PLUS, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email address to the "Subscribe to MFA Briefs" section at the bottom of this page.