A High-Level Analysis of Private Sector Health Insurance Business

December 20, 2022

Per the U.S. Bureau of Labor Statistics, there are approximately 128,000 large firms in the private sector, employing anywhere from 100 to more than 1,000 employees. These large, private-sector employers, i.e., companies not owned or operated by the government, continue to be attractive targets for health insurance businesses. The majority offer health and welfare benefits providing medical, dental, and vision coverage, with additional life and disability benefits for their employees. Large private-sector employers providing health and welfare benefit plans subject to ERISA [1] are required to file the annual Form 5500 with the Internal Revenue Service. Form 5500 is a primary source of employer information about health and welfare benefits, as well as pension plans. This brief presents a high-level overview of health benefit insights gleaned from Mark Farrah Associates’ (MFA’s) 5500 Employer Health Plus product. These observations are based on 80,438 employers that indicated they had active health benefit contracts as of their most recent filings.

Health Benefit Contracts by Participant Pool

A total of 80,438 private-sector employers reported in their most recent filing that they offer some type of health benefit (other than vision or dental) that is subject to ERISA guidelines. As reported, these companies collectively make health benefits available to about 86.9 million participants.[2] The following table presents private-sector employers that reported more than 500,000 potential plan participants across the spectrum of health benefit contracts. The top-ranking employer/sponsor is Amazon, the multinational technology and e-commerce giant. The second largest employer/sponsor is the NEA (National Education Association) Retiree Health Plan. The NEA is a professional organization representing teachers and other public-school personnel across the nation. The third largest is the retail superstore company Walmart. Other top employer/sponsors include Target, AT&T, and FedEx.

At the individual employer/sponsor filing level, the 5500 Employer Health Plus database includes useful observations about plan funding type. An assessment of the most recent filings found 43% of all benefit funding arrangements that included health benefits were fully-insured plans. Plans assessed as self-insured comprised 48%, while the remaining 8% were mixed funding arrangements. Large health insurers generally offer plans across all funding types.

Schedule A Observations

Within the Form 5500, Schedules A and C provide important insights about companies that private sector employers have contracted with for health coverage, welfare benefits, and other related services. Insurance carrier business was analyzed using Schedule A [3] and utilized data for only benefit contract types of health, HMO, and/or PPO. To provide a high-level overview of the market, the number of insured and total premiums paid were aggregated at the parent company level (Insurer Group) for each health plan/insurance carrier record. The Insured field represents the estimated number of persons covered at the end of the policy year, a field synonymous with covered lives or number of enrolled. The # Filings variable represents the number of filings in which each Insurer Group was reported, generally the same as number of contracts. Total Premiums in the table below are the sum of premiums paid for experience-rated and non-experience-rated contracts.

Kaiser ranked highest with an aggregate total of almost 4.7 million insured across 10,689 contracts. Metropolitan ranked second, reporting nearly 4.2 million insured or covered lives. UnitedHealth, CIGNA, and CVS were also in the top five insurers. As a reminder, it is important to note that Form 5500 definitions and reporting instructions pertaining to health benefits are broad and data are not necessarily indicative of comprehensive medical coverage.

In a previous brief focused on Form 5500 reporting, MFA noted that Insperity Holdings and ADP Totalsource, both PEOs (professional employer organizations), were leading accounts of the above firms. PEOs, functionally, sponsor health and other employee benefits for many employer groups. The utilization of these PEOs, and others, is expected to continue and may impact insurers and other benefits-related firms in the future, and analysis of Form 5500 filings can help monitor its growth.

Schedule C Observations

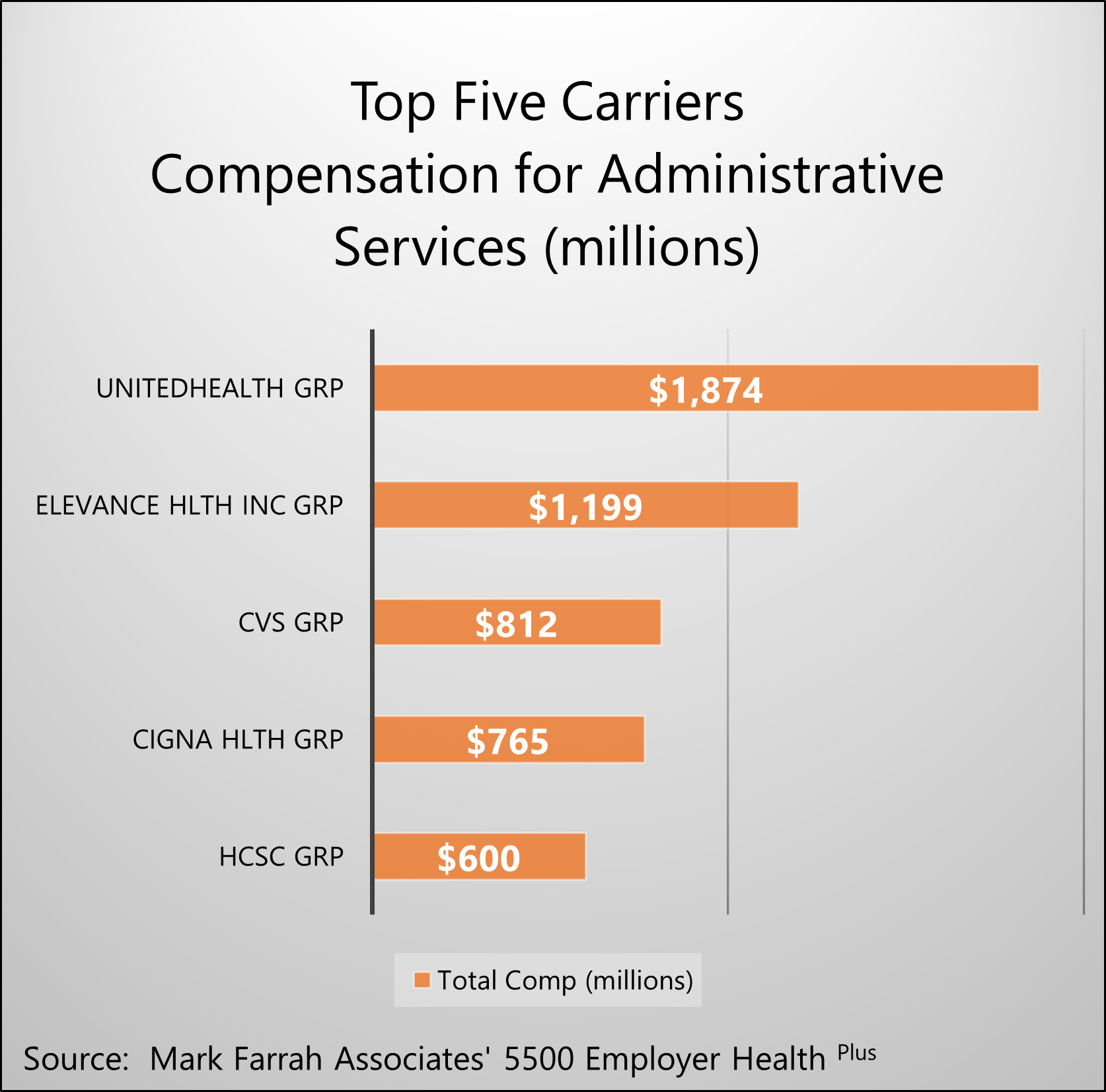

An analysis of Schedule C [4] data provided the following insights about insurance carrier compensation for administration of various types of self-insured benefit plans. UnitedHealth’s plans received nearly $1.9 billion in compensation for providing third party administrative services pertaining to health and welfare benefit contracts with private sector employers. Form 5500 filings show Nucor Corporation, Wells Fargo, and Delta Airlines were among UnitedHealth’s top employers relative to compensation paid for administrative services. Elevance (formerly known as Anthem Health), CVS, CIGNA, and HCSC round out the top five carriers based on compensation for administering self-insured plans.

Health Insurance Brokers

Using data from the most recent Form 5500 filings, MFA found brokers and agents received nearly $3 billion in fees and commissions for assisting with sales of various health and welfare benefit products, inclusive of health, HMO, and PPO contracts. Twenty-two percent of all broker compensation was for business in the state of California. Business in the states of Texas and New York also ranked high in the lineup, with each state accounting for 8% of the total reported fees and commissions reported. Brokers in the state of Florida represent 6% of all reported fees. Additional insights about broker compensation may be researched by agency, insurer group, and employer contract using MFA’s 5500 Employer Health Plus product.

About this Data

Due to filing guidelines and companies with different fiscal year ends, this subset of Form 5500 data generally encompasses filings from 2020 with a smaller amount from 2019 and 2021 to reflect the most recent filings available. Note: With respect to the designation of Insured Groups as parent companies, MFA makes every effort to accurately aggregate carriers by group but cannot guarantee 100% accuracy due to the lack of normalization within the filings.

About 5500 Employer Health Plus

The data used in this analysis brief was obtained from Mark Farrah Associates' 5500 Employer Health Plus. This tool has been designed to simplify the analysis of employer health & welfare benefits including medical, dental, vision, disability, and other benefits. MFA’s 5500 Employer Health Plus uniquely focuses on health & ancillary benefits purchased by private sector employers and the relationships employers have with contracted insurers, administrators, and brokers. The user interface allows for both detailed and summary level data retrieval. Data sources includes Form 5500 filings and related schedules for companies that indicate they provide health & welfare benefits.

About Mark Farrah Associates (MFA)

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. Our product portfolio includes Health Coverage Portal™, County Health Coverage™, 5500 Employer Health Plus, Medicare Business Online™, Medicare Benefits Analyzer™, and Health Plans USA™. For more information about these products, refer to the informational videos and brochures available under the Our Products section of the website or call 724-338-4100.

Healthcare Business Strategy is a FREE monthly brief that presents analysis of important issues and developments affecting healthcare business today. If you would like to be added to our email distribution list, please submit your email to the "Subscribe to MFA Briefs" section at the bottom of this page.

[1] The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans. Entities such as churches and state, city, and local governments are generally not subject to ERISA.

[2] It is important to note that “participants,” per Form 5500 instructions, is defined as the annual count of active and former employees who are eligible for said coverage, but not necessarily enrolled. Furthermore, this field is representative of participants across all health and welfare benefits reported by plan employer sponsors, not just health. Nonetheless, this measure provides a general indication of the potential size of health and welfare benefit contracts by employer.

[3] Employers generally use Schedule A to report information about insurance carriers and benefit plans, including premium amounts and broker/agent commission details for insured plans. Although benefit contract types are indicated within Schedule A, the premium amounts are not reported separately (e.g., health, dental, vision, disability).

[4] Information about benefit plans that are self-insured is generally reported in Schedule C. In many cases, the contracted carrier or TPA (third party administrator) generates this information for the employer. Schedule C provides details on fees associated with self-funded plans that exceed $5,000. Service provider fees are reported separately for direct compensation and indirect compensation arrangements. Although MFA’s data logic strives to eliminate filings that are primarily pension plan purposed, Schedule C does not include reporting of benefit contract types. Therefore, the compensation insights should be interpreted broadly as fees paid for contracts that may include health benefits.